Home insurance in Little Rock, AR, is a vital financial safety net, protecting your home from unexpected events like fires, storms, theft, and more. But when it comes to more specific issues—like gas line damage—many homeowners in Little Rock are left wondering: Is it covered?

This guide breaks down how gas line coverage works, what’s typically included in a standard home insurance policy, and how to make sure your home is fully protected.

Understanding Home Insurance in Little Rock

Home insurance policies vary based on your provider and the coverage you select. In Little Rock, most standard homeowners insurance policies include:

- Dwelling coverage

- Personal property coverage

- Liability protection

- Optional endorsements or riders

Gas line protection often falls under dwelling coverage, though it’s not always clearly outlined. That’s why it’s important to review your policy carefully.

Dwelling coverage protects the physical structure of your home from common perils like fire, windstorms, and vandalism. This protection usually extends to critical systems such as gas lines—especially those that are permanently attached or underground.

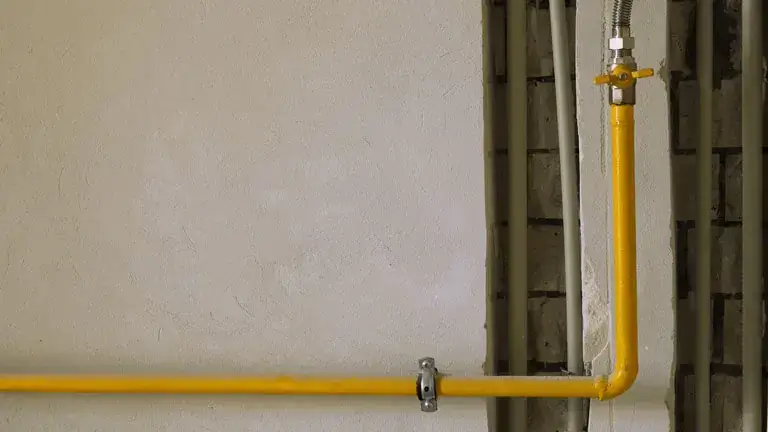

Gas lines power essential appliances like your furnace, stove, and water heater. Even though these lines are mostly hidden from view, they play a crucial role in your home’s functionality.

What Causes Gas Line Damage?

While durable, gas lines aren’t invincible. Here are some of the most common causes of gas line damage:

- Natural disasters – Earthquakes, heavy storms, and flooding can shift soil and crack or sever lines.

- Aging infrastructure – Over time, gas lines can corrode or deteriorate.

- Excavation or construction work – Digging for landscaping or home projects can unintentionally strike a buried line.

- Accidents – A vehicle hitting your home or nearby property could damage underground lines.

Understanding these risks helps you evaluate whether your insurance policy offers adequate protection.

Does Home Insurance Cover Gas Lines Damage?

It depends on the details of your policy. If you’re wondering specifically, does home insurance cover gas leaks, the answer depends on the cause and coverage type.

Here’s what to consider:

Covered: Sudden and accidental damage

Most policies cover gas line damage if it results from a covered peril—for example, a tree falls during a storm and damages the line. In this case, the cost to repair the gas line may be included under dwelling coverage.

Not Covered: Wear and tear

If damage occurs due to corrosion, age, or neglect, it’s generally considered a maintenance issue—not something insurance will pay for.

Consider Endorsements

Some insurers offer service line coverage or specific gas line endorsements. These optional add-ons offer broader protection and may cover damage from a wider range of causes, including underground wear or accidental impact.

Liability Coverage

If a third party—like a contractor or utility company—damages your gas line, your liability coverage may help cover repair costs or legal expenses.

Maintenance Requirements

Some insurance providers require routine maintenance or inspections to keep coverage valid. Be sure you’re aware of any such conditions.

How to Make Sure You’re Protected

If you’re unsure about your gas line coverage, take these steps:

- Review your policy – Look for language related to service lines or underground systems.

- Speak with your insurance agent – Ask if gas line damage is covered and whether additional coverage is recommended.

- Consider a policy upgrade – Adding an endorsement could save you from expensive out-of-pocket repair costs.

- Schedule regular maintenance – Keeping your system in good shape helps prevent problems and supports your claim eligibility.

Final Thoughts

In Little Rock, standard home insurance doesn’t always include gas line damage. However, that doesn’t mean you’re unprotected. With the right policy and possible endorsements, you can safeguard your home from unexpected repairs and potential safety risks.

At G&G Independent Insurance, we specialize in helping Little Rock homeowners find the right coverage for every situation—including gas line protection. We work with multiple top-rated insurers to match you with policies that fit your needs and budget.

Get a Free Quote Today

Don’t wait until a gas leak or sudden repair catches you off guard.

Contact G&G Independent Insurance today to review your policy or get a free home insurance quote with gas line coverage options.

Protect your home. Protect your peace of mind.