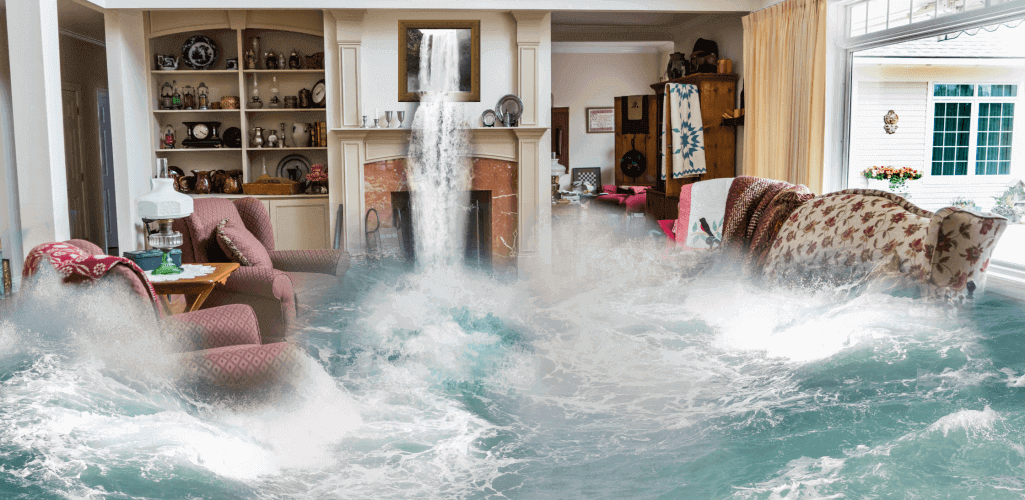

Everything seems calm. Life is normal, even peaceful. Maybe you hear a passing mention of bad weather on the news. Then, within a few days, rising water submerges your home, business, and community.

This is how floods cause billions of dollars in damage every year to homes and businesses across the U.S. In this article, we’ll break down how floods impact properties and most importantly, how to prepare and protect yourself financially from the consequences.

Are You Underestimating the Financial Impact of a Flood?

Many people assume a flood won’t happen to them. Others believe their standard homeowner’s or business insurance covers it. Unfortunately, both assumptions are often dangerously wrong.

If you’re underestimating the financial damage a flood can cause, we’ll clear that up. And if you’re already concerned about the risk, you’re in the right place. Keep reading — we’ll walk you through how flood damage happens, what it costs, and how flood insurance works to protect your future.

What Kind of Damage Can Flooding Cause?

Flooding is the most common and expensive natural disaster in the United States. Causes range from:

-

Hurricanes

-

Excessive rainfall

-

Rapid snowmelt

-

Overflowing rivers and lakes

-

Storm surge or infrastructure failure

The extent of the damage depends on the water level, speed, duration, and vulnerability of your property. Whether it’s a home or business, no structure is immune to the effects.

How Floods Affect Homes

Floods can damage every part of your home. Here are some of the most common and costly issues:

-

Structural Damage: Floors can buckle, roofs can collapse, and foundations can crack or shift. Entire homes can be swept away in severe floods.

-

Electrical Systems: Wiring can fray or short-circuit, leading to system-wide outages and expensive repairs. Appliances like refrigerators, HVAC systems, and water heaters may be destroyed.

-

Water & Sewage Systems: Floodwater can clog septic systems and contaminate well water, creating serious health risks.

-

Mold and Mildew: Mold can grow on damp surfaces within 24–48 hours, posing both health and structural hazards.

In flood-prone areas, every part of your home — from the floors to your furniture — is at risk.

How Floods Affect Businesses

If your business has a physical location — such as a shop, office, or warehouse — the damage can be just as severe:

-

Inventory & Equipment Losses: Products, machinery, and raw materials can be destroyed beyond repair.

-

Structural Damage: Just like homes, commercial buildings can experience foundational and electrical issues.

-

Financial Disruption: Beyond physical damage, floods can force temporary closures, customer loss, and long-term revenue impact.

Flooding doesn’t just damage your property — it can put your entire operation on hold, or worse, out of business.

Can You Afford to Rebuild?

Even a few inches of water can cause $25,000 or more in damage. Repairs, replacements, and lost income add up fast. Most people aren’t financially prepared to absorb those costs overnight.

So how do you protect yourself from the financial devastation of a flood?

The Solution: Flood Insurance

You can’t stop floods from happening, but you can prepare for the aftermath. The smartest way to do that is by purchasing flood insurance.

Here’s the catch: Standard homeowner’s or property insurance usually does not cover flood damage. That means unless you specifically purchase a flood insurance policy, you’re likely unprotected.

What Is Flood Insurance?

Flood insurance is a specialized property insurance policy that covers damage caused by flooding — including damage from:

-

Heavy rainfall

-

Snowmelt

-

Coastal storm surge

-

Blocked drainage systems

-

Levee or dam failure

Flood insurance is available for residential and commercial properties and can be purchased through:

-

Private insurance companies

Want to learn more about what flood insurance covers and common questions around it? Check out this helpful guide by G&G Independent Insurance: Flood Insurance Coverage Facts & FAQs

How Does Flood Insurance Work?

Like other insurance policies, flood insurance requires you to pay an annual premium, which is based on:

-

Your property’s location and flood risk

-

The value of the structure and contents

-

The deductible you choose

If a covered flood damages your property, the insurance pays for repairs or replacement costs, up to your policy limits.

NFIP coverage limits:

-

Up to $250,000 for residential buildings

-

Up to $500,000 for commercial buildings or contents

-

Separate deductibles for building and contents

⚠️ Important: There is a 30-day waiting period after purchase before coverage begins. Don’t wait until the rain starts!

What Does Flood Insurance Cover?

A typical flood insurance policy covers:

Structural:

-

The building and its foundation

-

Electrical and plumbing systems

-

HVAC units (heating/cooling)

-

Water heaters and appliances

-

Built-in furniture, carpeting, cabinets, and paneling

-

Detached garages (up to 10% of structural limit)

Personal Property:

-

Furniture and clothing

-

Electronics

-

Kitchen appliances

-

Curtains, rugs, and wall decor

-

Art, valuables, and some jewelry (up to limits)

Policies can often be customized, so ask your provider about extended coverage options.

What Isn’t Covered?

Flood insurance does not cover:

-

Damage beyond your policy limits

-

Landscaping, pools, fences, or exterior features

-

Vehicles

-

Items stored in basements (in many policies)

-

Living expenses during repairs (e.g., hotels, rentals)

Always read your policy carefully and ask your provider what is and isn’t included.

Many homeowners assume their standard insurance covers flooding — but it usually doesn’t.

To better understand the difference between flood insurance and typical water damage coverage, check out this helpful comparison: Flood Insurance vs. Water Damage Coverage

Who Needs Flood Insurance?

If your home or business is in a high-risk flood zone, flood insurance is essential. However, even low-to-moderate risk areas account for over 20% of flood claims.

If you’re in a low-risk zone, your premium will be lower — and still offer the financial protection you need if disaster strikes.

Bottom line: If your area has any flood risk, flood insurance is worth it. If not, it may be a safe choice to skip — but make that decision carefully.

Conclusion

Flooding is the most frequent and most costly natural disaster in the U.S. Every year, it causes billions in losses — and in just minutes, it can destroy what took a lifetime to build.

Are you prepared? Or are you taking the risk lightly?

Act now — before the next storm hits. Get a personalized quote and secure your flood insurance policy through G&G Independent Insurance. Don’t wait until it’s too late to protect your home or business from devastating losses.