It was a bright, sunny day, and then all of a sudden – it happened.

In the insurance world, it can be a number of things. It could be a newbie teenage driver that’s too busy ‘jamming out’ to the newest Pop hit to see you hit your brakes. Or maybe it’s the annual Thanksgiving turkey fry that got a little crazy and caught the house on fire. Or it might be you went on vacation and came back to a soggy, flooded basement in your house.

Whatever it is, it’s usually not very fun at all and has you peeking into every piggy bank you might have stowed away.

Hey, but that’s what insurance is there for, and it comes in pretty handy in these types of situations and protects you from huge financial losses when the unexpected happens. And filing an insurance claim might be the best thing to do, depending on the damage you’re facing.

What exactly is an insurance claim?

An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event, such as a car wreck or house fire.

Once an insurance claim is filed, the insurance company typically sends a representative called an insurance adjuster to look into what occurred. From there, they will review the claim and if approved, you’ll receive a payout to cover your losses.

If you haven’t filed a claim before, there’s a good chance you will at some point in your life. However, the question is: do I always have to file a claim?

When should I file an insurance claim?

Just like most things in life, deciding on whether to file a claim or not can be a bit of a gray area. However, there are some general guidelines you can follow to help make a decision.

Typically, we recommend checking your deductible amount before deciding to file a claim. It’s more than likely not worth filing a claim if your deductible is less than the estimated damages (or even if the damage is just a couple hundred dollars higher than it). For example, if you are in a fender bender and it’ll cost $800 to repair your car and your deductible is $1,000, we’d advise you to not file a claim.

Another important note is to consider how your premium rates will be impacted by a claim. Even if you’re not at fault or it’s a natural disaster that caused the damage, there’s a possibility your rates will go up when your policy renews. It’s even possible the insurance company will cancel your policy in certain situations. That’s why it’s important to investigate before filing and claim and to be with an independent agency that can have you paired with the best company for your particular circumstances.

While there are times when it’s not recommended to file, here are some specific cases when you should definitely consider filing a claim:

- When there is an injured person involved

If you are in a car wreck and you or any other individual is hurt, we’d recommend filing a claim.

- When who is at fault is not clear

If it’s an accident where it’s hard to tell who’s to blame or it’s a confusing timeline of events, it’s probably best to file and let the insurance companies sort through it.

- When it’s a ‘total loss’ or the damages are not affordable

For example, let’s say your car is totaled. That new pile of metal is probably going to set you back several thousands of dollars. For a lot of people, that’s too much to take on by yourself. In this case, it makes sense to file and use insurance for what it’s there for.

Every situation is different, so we are here to help advise you on the claim process. We are your advocate, not the insurance company’s, so please contact us if you want to talk through the pros and cons of filing a claim.

How do I file an insurance claim?

How about we use this scenario: you’ve just been in a massive car wreck and the entire back of your car is smashed to bits. Luckily, everyone is okay, but it’s safe to say your car is completely totaled and it’s time to file an insurance claim.

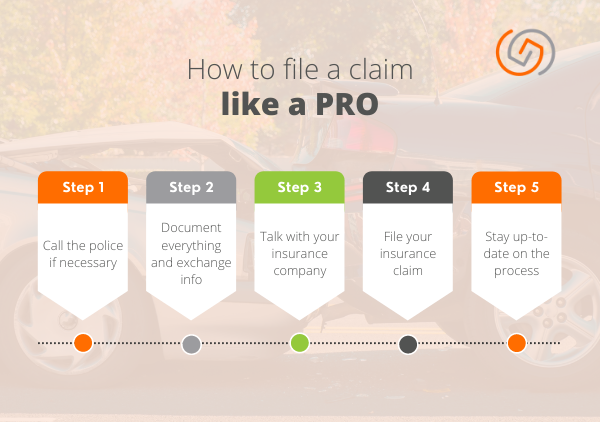

So where do you go from here? That’s where we come in! Here are a few vital steps to take to file your claim.

#1: If needed, call the police

If someone is injured, there was a crime involved, or the damage is considerable, by all means, call 911! Also, it’s not required to file a claim, but a police report doesn’t hurt to have either so there is plenty of information documented. This can come in handy for the claim process if there are questions about who is and isn’t at fault.

#2: Share info and keep documentation

Next, make sure you receive information from everyone that is involved so you’re prepared for the next steps. You don’t have to document every single second of the event, but be sure you have at least these bits of info for auto claims:

- Name, address, and phone number of the other parties involved and a photo of their driver’s license, if applicable and available

- Insurance policy numbers

- Year, make, model, and license plate numbers of all the vehicles involved

- Photos of the wreck from all sides and angles

- Detailed notes from the people involved about the accident

If you do get hurt and need medical help, keep copies of any physician reports, medical bills, and any other documents you get while treating your injuries.

And how does this compare to home insurance claims? Here are the main things to keep track of and do when it’s on your home insurance:

- Capture photos of any of the damage done to your house

- Keep a list of any personal items or property that was damaged or stolen if it’s due to a robbery or other crime

- If your home is unlivable and you have to stay elsewhere, keep any receipts as proof of living costs

#3: Speak to your insurance company

This is where G&G comes in! We are YOUR advocate, not the insurance company’s. From here, we’ll advise you on the ins and outs of the process and advise you when needed. While the insurance company sends the adjuster and has the final say, we are here to help move the process along and work on your behalf with them.

Please contact us if you need to file a claim or need help during the claim process.

If it’s after our normal business hours, you can also find a list of our top insurance companies here to contact directly.

#4: File your insurance claim

You’ve finally made it to the filing stage! Don’t worry, you don’t have to do this on your own. Give us a call and we’ll take care of the rest for you.

I Filed A Claim, Now What?

Phew, you made it! But what happens next? After you file your claim, the insurance company is going to send an insurance adjuster to look into the accident and any of the damages that were done.

The insurance adjuster will investigate all of the details and documentation to see the full picture of what happened. After that, they will recommend how the claim should be handled by the insurance company.

If you are dealing with the other company’s adjuster don’t feel like you have to settle if you feel that their settlement offer is unfair. The other company’s goal is to not have to pay as much as possible, so be prepared with thorough documentation and evidence to counter any low-ball offers.

Filing a claim and receiving your claim payout can be a complex, confusing process. Which is why we’re here! We’ll advocate on your behalf and walk you through everything you need to know to get the most out of your insurance. We are ready to help with whatever life throws your way.

Contact us today!