Financial Risks of Being Uninsured in Arkansas

Let’s be real—no one likes paying for insurance. But you know what’s worse? Paying way more when something unexpected happens and you’re not covered. Going without insurance might feel like saving money… until it costs you a lot more.

No Health Insurance = Big Medical Bills

A simple ER visit can cost over $1,000 without insurance. Break a leg? That’s $7,500. Need surgery? Think $30,000+. Without coverage, those bills land squarely on your lap—and they don’t come with a payment plan from your fairy godmother.

No Auto Insurance = Repairs & Lawsuits

Arkansas law requires auto insurance for a reason. If you’re in an accident and you’re uninsured, you’ll be on the hook for repairs (yours and theirs), medical bills, and legal fees if you’re sued. And let’s not forget your car—fixing or replacing it without coverage can cost thousands.

No Home Insurance = Starting Over Alone

A fire, tornado, or break-in could wipe out your home and everything in it. Without homeowners insurance in Arkansas, you’re looking at tens or even hundreds of thousands in damage—and no financial backup to rebuild.

No Business Insurance = Shuttered Doors

If a customer slips and falls or your equipment is stolen, an uninsured business could go belly-up fast. A single lawsuit could deplete your savings or put you out of business entirely.

Bottom line: Not having insurance might save you a little now, but it could cost you everything later. Don’t gamble your future on a short-term shortcut.

Arkansas Insurance Laws: What You Need to Know

Arkansas takes insurance seriously—especially when it comes to auto coverage. Certain types of insurance, like auto insurance, are legally required across the state. If you’re caught driving without proper coverage, the consequences can be steep.

Penalties for Driving Uninsured in Arkansas

Getting behind the wheel without insurance can result in:

- Fines ranging from $150 to $1,000

- License suspension

- Vehicle impoundment

- A requirement to file an SR-22, a certificate proving you carry insurance, often triggers higher premium rates

Beyond financial penalties, uninsured drivers who cause an accident may face lawsuits, court fees, wage garnishment, or even liens on personal property.

For the most accurate and up-to-date information, visit the Arkansas Insurance Department.

Health Insurance in Arkansas

While Arkansas doesn’t have a state-level mandate requiring health insurance, going without coverage can still put you at serious financial risk. Major medical expenses can quickly pile up, and depending on your situation, you may still face penalties under federal health care laws.

To explore your options and avoid unexpected medical bills, check out the official Health Insurance Marketplace.

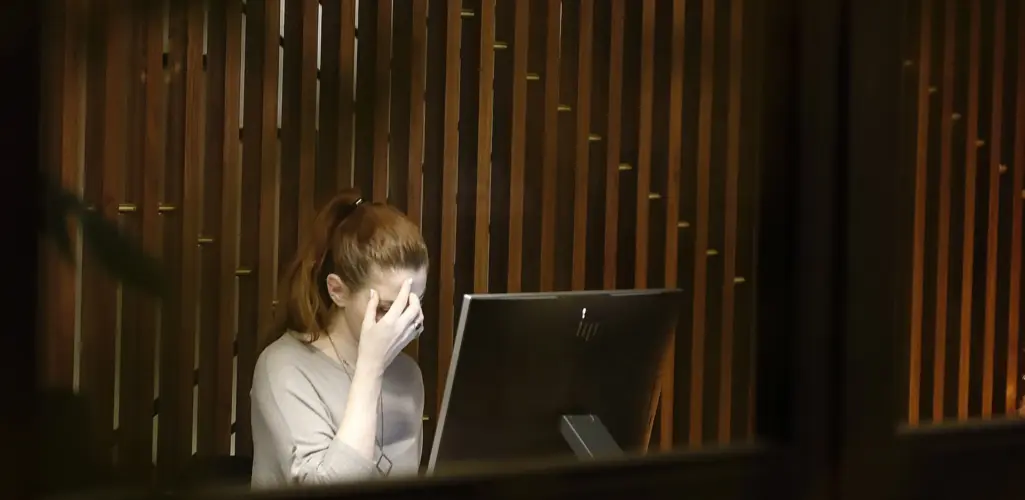

Personal and Emotional Impact of Being Uninsured

Beyond dollars and fines, being uninsured brings a heavy emotional toll. The stress and anxiety from sudden, unexpected expenses can weigh on you and your family like a storm cloud that just won’t pass.

Imagine facing a medical emergency or a car accident and not knowing how you’ll pay the bills. Or worse, losing your home or business without a safety net. That uncertainty can shake your sense of security and peace of mind.

Without insurance, you risk losing your savings—or even your assets—trying to cover costs that insurance would normally handle. This financial strain often affects family stability, creating tension and worry over what’s next.

In short, the cost of being uninsured isn’t just about money—it’s about protecting your family’s future and your peace of mind.

How Arkansas Residents Can Protect Themselves

The best way to avoid the costly risks of being uninsured is simple: get the right insurance coverage for your needs. Whether it’s auto, home, health, or business insurance, having adequate protection can save you thousands—and a whole lot of stress.

Working with an independent insurance agency like G&G Independent Insurance gives you a huge advantage. Instead of shopping one company at a time, G&G’s in-house software compares rates from 50+ top insurers to find the best coverage at the best price—all tailored to Arkansas residents.

Here are a few tips to help you find affordable insurance in Arkansas:

- Compare multiple quotes to avoid overpaying.

- Bundle policies like auto and home for discounts.

- Maintain a good credit score to qualify for better rates.

- Ask about discounts for safe driving, security systems, and more.

- Review your coverage annually to keep it up to date with your life changes.

Using the right tools and expert agents means you don’t have to navigate the confusing insurance maze alone. Ready to protect your future without the hassle?

Get your personalized Arkansas insurance quotes today!

Why Choose G&G Independent Insurance

At G&G Independent Insurance, we make it simple to find affordable, reliable insurance in Arkansas. Unlike agents who represent just one company, we partner with over 50 top-rated insurance carriers—giving you access to the best rates and coverage options, all in one convenient place.

We know Arkansas. Whether you need auto, home, renters, or business insurance, our local team understands the unique risks and needs of Arkansas residents. We offer personalized advice tailored to your situation—so you can make informed decisions without the stress or guesswork.

But don’t just take our word for it—thousands of satisfied clients trust G&G to protect what matters most. Our friendly, knowledgeable agents are here to answer your questions and help you find the right policy at the right price.

Ready to make insurance simple?

Let G&G Independent Insurance be your trusted partner in peace of mind.

Conclusion

Being uninsured in Arkansas comes with more than just financial risks—it can jeopardize your peace of mind, your family’s stability, and your long-term security. From steep fines to unexpected emergencies, the consequences of going without coverage are too serious to ignore.

Don’t leave your future to chance.

Take control today with insurance tailored to your life and needs.

Contact G&G Independent Insurance for a free, personalized quote, and let us help you protect what matters most—with confidence, clarity, and care.